What to Expect at GRC Summit 2025:

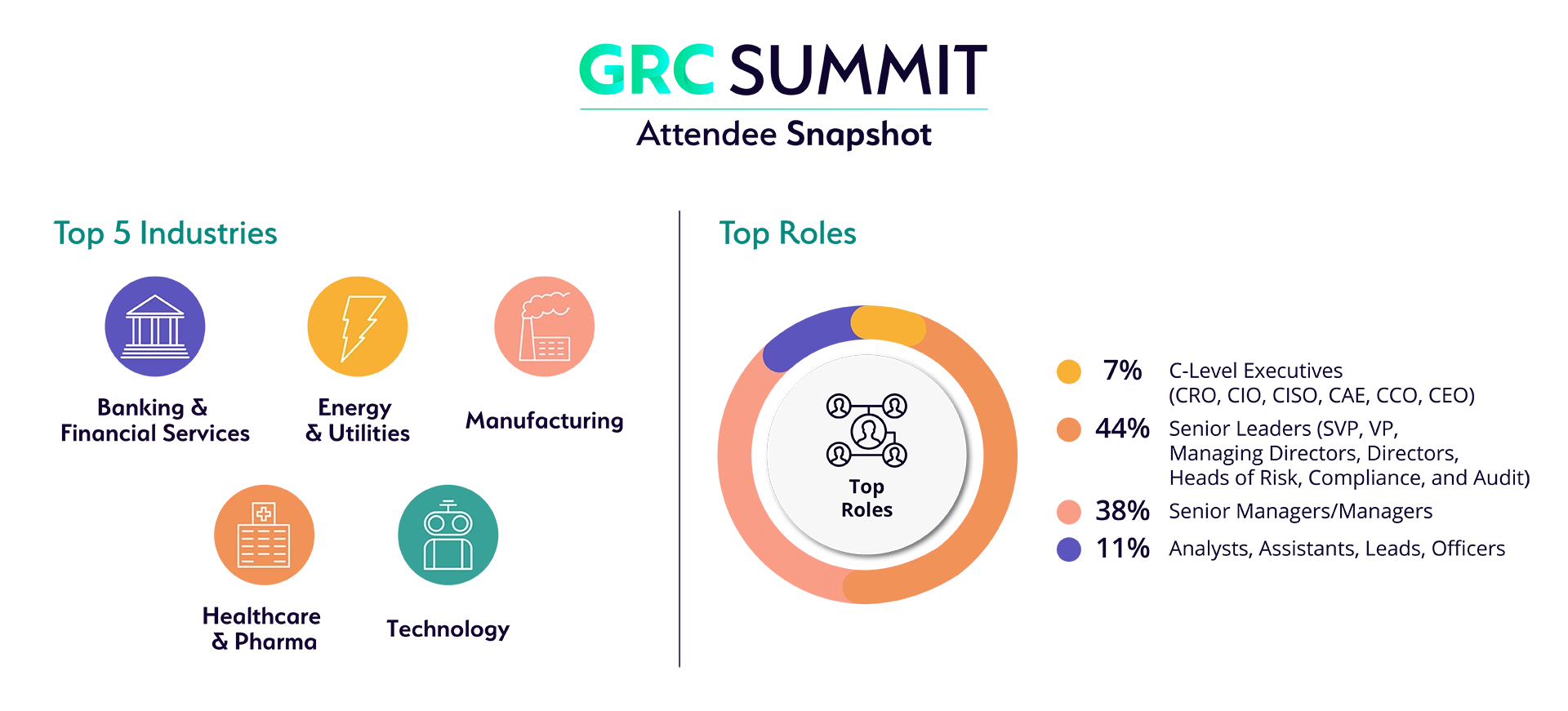

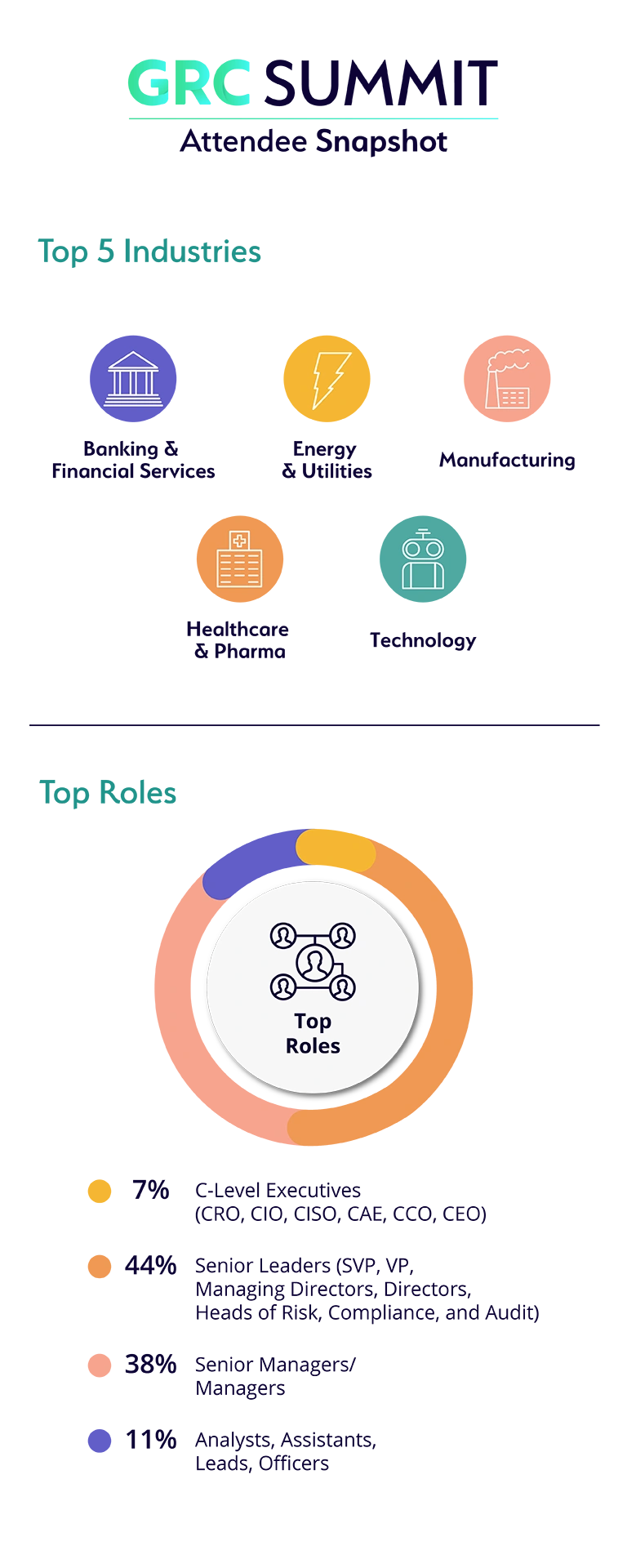

The 2025 GRC Summit, hosted by MetricStream, is a leading annual event that brings together top experts from government and business to explore the latest strategies in Governance, Risk, and Compliance (GRC). Join over 300 professionals to gain insights from thought leaders, engage in interactive discussions, and discover best practices in risk management, compliance, cyber risk, ESG, and more. Elevate your GRC programs and learn how to transform risk into a strategic advantage.

- Learn from Global Thought Leaders and Experts.

- Engage Deeply in Our Interactive Workshops.

- Gain Insights from Real-World GRC Case Studies.

- Access Exclusive Insights from Keynote Presentations.

- Stay Ahead of Evolving Compliance Requirements.

- Keep Up-To-Date with The Latest Trends in GRC.

- Network with Top Industry Professionals.

- Explore MetricStream's Products and Solutions In-Depth.

- Earn Continuing Professional Development (CPD) Credits.

Join us at the GRC Summit on 10-12 June, 2025 at the Royal Garden Hotel in London, UK.

Why Attend?

Hover over a topic below to see what you can expect to take away from the event

Enterprise & Operational Risk

Future-proof your enterprise risk management. Uncover new methodologies to anticipate, assess, and mitigate emerging risks in a dynamic environment.

Regulatory and Corporate Compliance

Explore the future of regulatory compliance and discover emerging trends and strategies to stay ahead in a rapidly changing landscape.

IT & Cyber Risk

What's next in cybersecurity? Explore cutting-edge technologies and strategies to protect your organization from future cyber threats.

Internal Audit

The future of internal audit. Discover innovative strategies and tools to enhance audit processes, ensuring your organization remains agile and compliant in an evolving regulatory landscape.

Operational Resilience

What's next in operational resilience? Prepare your organisation for future challenges with innovative approaches to ensure continuous operations.

Third-Party Risk Management

Stay ahead in third-party risk management. Learn how to navigate the evolving landscape of partnerships with advanced tools and strategies.

Speakers

Rajeev Bhatnagar

Chief Risk and Compliance Officer, International and Treasury Services

The Bank of New York

Rajeev Bhatnagar

Chief Risk and Compliance Officer, International and Treasury Services, The Bank of New York

Rajeev Bhatnagar is the Chief Risk and Compliance Officer for BNY’s International business. Based in London, Rajeev is responsible for managing risk and compliance across all risk and compliance disciplines for all businesses and legal entities in APAC, EMEA and LATAM. He is also the global Chief Risk and Compliance Officer for Treasury Services. Rajeev has more than 30 years of international banking experience. Prior to joining BNY in 2020, he was in senior roles at Commonwealth Bank of Australia for over six years and at Citigroup for 21 years. Rajeev has broad-based banking and risk management experience, spanning corporates and financial institutions, business banking and retail banking. In risk management, he has held Chief Risk Officer roles at country, regional and global levels. He has managed teams across all risk categories, including credit risk, operational risk, market risk, compliance and financial crime compliance. Rajeev is an Engineer and holds a master’s in business administration.

Victoria Stubbs

Managing Director, Compliance

Barclays UK

Victoria Stubbs

Managing Director, Compliance, Barclays UK

Victoria is an experienced risk and compliance leader. She is is currently a Managing Director in Compliance at Barclays. Previously, Victoria was the Chief Risk and Compliance Officer at the Cambridge Building Society, where she was awarded Outstanding Chief Risk Officer by Credit Strategy in 2019 and was previously Deputy Chair of the PRA Practitioner Panel.

Lucy Da Piedade

Managing Director, Former Chief Controls Officer

Barclays Bank

Lucy Da Piedade

Managing Director, Former Chief Controls Officer, Barclays Bank

Lucy da Piedade is a Risk Management leader with almost 30 years of experience spanning global financial services, risk advisory consulting, external audit and legal professional practice. She was until recently the Chief Controls Officer for Consumer Banking and Payments at Barclays Bank responsible for first line of defence risk management for a portfolio of businesses including the Global Corporate and Transaction Bank, Private Bank and Wealth business, as well as the International Consumer Bank. Her focus is on identifying and addressing all non-financial risks in the business including Data, Privacy and Resilience Risk. She trained as a lawyer in South Africa and the UK and began her career in commercial legal practice. She was an International Trade Remedies consultant with Deloitte & Touche later joining KPMG in their Taxation as well as Risk Advisory and External Audit practice in London. She served as a Business negotiator in the tripartite team responsible for concluding the trade agreement between South Africa and the European Union in her capacity as International Trade Manager at the South African Chamber of Business. Lucy holds an Master of Law degree from Exeter University in the UK and a MBA from the University of the Witwatersrand and Cranfield University in the UK. Fluent in five languages, she is a passionate advocate for diversity of thought and the importance of culture in effective risk management, regularly presenting on these topics to industry audiences.

Nick Woods

Chief Auditor - Risk, Credit, Financial Crime

NatWest Group

Nick Woods

Chief Auditor - Risk, Credit, Financial Crime, NatWest Group

Nick is a Chief Auditor at NatWest, focused on Risk, Credit and Financial Crime and also sponsoring work on the future shape of NatWest's Internal Audit function. Nick has worked in external audit, internal audit and first line controls roles across a thirty year career in the financial services industry. Prior to joining NatWest in 2023, Nick was Chief Controls Officer at Nationwide. A Chartered Accountant and Chartered Member of the Institute of Internal Auditors, Nick has also led audit and controls teams across Barclays, Northern Trust, Prudential and UBS, working across many aspects of the industry including Asset & Wealth Management, Cards & Payments, Retail Banking and Custody/Fund Services.

Jacob Holmehave

Head of Group Risk Office

Nordea

Jacob Holmehave

Head of Group Risk Office, Nordea

Jacob is a former external consultant and key note speaker within change management and transformation. Today, Jacob is the business owner of the development of Nordea’s new GRC implementation, Integrated Risk Management Application (IRMA) – a large digital and cultural transformation that will change the way Nordea work with risk management and compliance within all 3 lines of defense.

Libby Denchfield

Global Head, Systems & Operations - Operational, Technology & Cyber Risk

Standard Chartered Bank

Libby Denchfield

Global Head, Systems & Operations - Operational, Technology & Cyber Risk, Standard Chartered Bank

Libby has over 20 years’ experience in a variety of senior global banking and markets businesses, in both the first and second lines of defense. These roles have provided a unique insight and understanding of the interplay between multiple risk disciplines, including financial crime, operational, reputational, regulatory, information and cyber security, and conduct risk management.

In her current role, as the Global Head of Operations, Systems, Reporting & Analytics for the Operations, Technology & Cyber Risk second line team at Standard Chartered Bank, she is responsible for the management of all financial performance and non-financial risk management for the function and delivery of the strategic change agenda, which includes overseeing the systems that support the achievement of risk and regulatory compliance.

Previously at SCB she has been responsible for implementing the front office supervision framework and Senior Managers’ Regime for the global financial markets business, leading the Bank’s global conduct risk programme, managing the all the non-financial risks for the European global banking business, and leading the European operations division for financial markets. Before joining SCB she held several senior executive roles in RBS (including COO of the Global Restructuring Group), Goldman Sachs, Deutsche Bank, and BNP Paribas.

Fabien Robichon

Head of Compliance Analytics and Innovation

Zurich Insurance Group

Fabien Robichon

Head of Compliance Analytics and Innovation, Zurich Insurance Group

Around 20 years experience in IT strategy, IT risks, IT governance, analytics, innovation, GRC, digitalization and AI. Significant international experience, working for various industries, now leading digitalization and innovation for second line of defence at Zurich Insurance Group.

Tetiana Isaieva

Head of Compliance

Roche

Tetiana Isaieva

Head of Compliance, Roche

A steadfast advocate for innovation and collaboration, Tetiana envisions a world where healthcare is not just a privilege, but a fundamental right for all.

With a wealth of experience as an international leader in Life Sciences, she is passionately dedicated to shaping the future of the industry through healthcare policy and systems advancements.

Master’s degrees in International Business Law and Relations along with 20+ years of experience in international business, laws, ethics, risk intelligence, opportunities exploration, technology domains, continuously enriching her capacity to drive meaningful change.

Tetiana excels in orchestrating global initiatives that encompass governance, digital transformations, innovations and partnerships, all aimed at ensuring enhanced access to healthcare for patients in multiple countries and continents.

Her extensive advisory background and resilience empowers her to navigate complex challenges in an uncertain environment, while her visionary leadership inspires others for collective efforts towards a healthier future.

Benjamin Rowsell

Head of Enterprise and Operational Risk

Nationwide Building Society

Benjamin Rowsell

Head of Enterprise and Operational Risk, Nationwide Building Society

Ben is a Chartered Accountant who has worked in risk and control disciplines within large Financial Services businesses for almost 25 years. Roles have spanned the three lines of defence, as well as several years as an external reviewer. His current role is at Nationwide, where he has spent the last 9 years – with responsibilities centred around setting the risk framework; overseeing its application; and reporting on risk insights.

Elena Garcia Aguado

Head of Compliance

RWE Renewables

Elena Garcia Aguado

Head of Compliance, RWE Renewables

Elena García Aguado is the Head of Compliance at RWE Renewables , where she leads the design and implementation of a comprehensive compliance management program for the Onshore and PV renewable energy sector. Her role includes advising on strategic compliance measures related to antitrust, corruption, money laundering, and international sanctions. Elena is a Spanish-qualified lawyer, with over 20 years of experience in the legal and compliance sectors in Spain, Belgium and Germany. She is fluent in Spanish, German, English, and French.

Nick Fuller

Global Head of Resilience Risk Management

The Bank of New York

Nick Fuller

Global Head of Resilience Risk Management, The Bank of New York

Nick Fuller is the Global Head of Resiliency Risk Management and Head of International Technology Risk Management at BNY. In these roles, he provides independent oversight and challenge of the firm's operational resiliency capabilities and technology risks, including the enterprise resiliency lifecycle, testing program and response capabilities. Before joining BNY, Nick led the development of Credit Suisse’s approach to operational resilience. Prior to that, he was the EMEA Head of Business Continuity Management, with over 20 years of experience in developing and implementing a firm-wide business continuity and crisis management framework. Nick has managed a wide variety of crisis events, including system outages, environmental issues, and civil unrest. In addition, he is actively engaged in industry collaboration, including previously being co-chair of the Securities Industry Business Continuity Management Group (SIBCMG) and supporting the development of multiple UK and international industry exercises.

Dino Placido Bivona

IT Business Partner - GRC Corporate Functions

Zurich Insurance Group

Dino Placido Bivona

IT Business Partner - GRC Corporate Functions, Zurich Insurance Group

With over 25 years of IT experience, I have built a career at the intersection of technology, governance, risk and compliance (GRC). Since 1999, I have contributed to IT strategy, project delivery and operational excellence. Supporting business transformation across industries. Based in Zurich since 2007, I have partnered with global organizations to drive IT initiatives, ensuring alignment between technology and regulatory requirements. My expertise spans IT project management, operations & service delivery, with a strong emphasis on enabling business functions through secure, compliant and efficient IT solutions. Currently, my focus is on GRC transformation, helping organizations navigate regulatory landscapes, mitigate IT risks and strengthen compliance frameworks in an era of digital disruption. Passionate about emerging technologies, I see AI as a key enabler for the future of governance, risk management and compliance. Keen on leveraging its potential to drive innovation and efficiency.

Chris Knox

Global Director - Financial Services Regulatory Compliance

Microsoft Corporation

Chris Knox

Global Director - Financial Services Regulatory Compliance, Microsoft Corporation

Chris is currently a Director within Microsoft’s Worldwide Financial Services Regulatory Compliance team where he engages with regulators and customers on topics such as Operational Resilience, Cyber Security, Third-Party Risk and forthcoming AI regulation. Prior to Microsoft, Chris was a regulator at the PRA focusing on Operational Resilience and Cloud Outsourcing across multiple Banking, Insurance, and Investment firms. Chris has also worked directly within the 1LoD and 2LoD within an Operational/Technology Risk capacity and started his career at KPMG in London. He graduated from the University of St Andrews in 2013 and professional certifications include CISSP, CISM, CISA & CRISC.

Brian F. Sørensen

Chief Project Manager - Group Risk Change Management

Nordea

Thoralf Knuth

Chief Data Protection Officer

Robert Bosch

Thoralf Knuth

Chief Data Protection Officer, Robert Bosch

Experienced Tech and Compliance lawyer with a proven track record in private practice, corporate and business. Focusses on wholistic GRC approaches. Chief Data Protection Officer at Bosch Group, former Deputy Head of Compliance Investigations at Bosch Group, former senior attorney at Freshfields, former project manager and customer care. Fully qualified lawyer. Fable for happiness.

Sarah Garrington

Head of Resilience

Royal London Group

Sarah Garrington

Head of Resilience, Royal London Group

Sarah has worked within the resilience industry for over ten years, building resilience functions in firms across the legal, financial and professional services sectors. Sarah’s career has spanned Business Continuity, Incident Management and Operational Resilience practices, and her current role focusses on continued compliance with the Operational Resilience UK regulation for March 2025. In addition, Sarah has a particular interest in supplier resiliency and third party compliance, and she is dedicated to ensuring that the next generation of resilience professionals have the relevant opportunities to welcome them into the industry.

Tim Armit

Head of Operational Resilience and Business Continuity

QBE

Tim Armit

Head of Operational Resilience and Business Continuity, QBE

Tim Armit is Head of Operational Resilience and Business Continuity for QBE. He has worked in resilience for 36 years working across over 100 companies in all sectors around the world, responsible for the innovation and implementation of a number of resilience practices. He served as an Officer in the Army and then joined Guardian Royal Exchange working in IT before moving into full time resilience in 1989. From GRE to the Post Office ensures he has first hand experience of all aspects of resilience and using plans in anger. He developed the first methodology for implementing Turnbull processes leading to what is now known as operational risk and was responsible for developing the first BS7799 software assessment tool. He is also the first consultant to complete every aspect of the business continuity lifecycle up to and including achieving accreditation to BS25999 for a client before it transitioned to the ISO standard now in place. He has managed global resilience projects operating in up to 16 countries simultaneously and understands the impact of the global risks in large companies. Tim was the lead for the UK Tripartite to benchmark the UK financial sector and has helped establish a consultancy in Spain in conjunction with the BME (Spanish Stock Exchange).

Claudia Iacobucci

Head of Assurance, Risk and Internal Controls

ABB

Claudia Iacobucci

Head of Assurance, Risk and Internal Controls, ABB

Head of Assurance, Risks, and Internal Controls at ABB, with over 20 years of experience in developing and strengthening SOX compliance and internal control frameworks across pharmaceutical and engineering sectors. Specializes in integrating emerging technologies and new trends into risk and control environments to drive operational excellence.

Dave Pickering

Head of Non-Financial Risk Taskforce

Canada Life UK

Dave Pickering

Head of Non-Financial Risk Taskforce, Canada Life UK

Dave has worked in financial services for 36 years, starting his career at Nationwide Building Society, where he held a number of senior roles in internal audit and compliance. Dave joined the Lending Standards Board (LSB) as Compliance Director in July 2013, and became CEO in 2016. Dave worked closely with the industry and the regulators in developing self-regulation and voluntary standards as a key complement to statutory regulation, enabling firms to deliver good customer outcomes in SME lending, APP scams and branch closures, with the emphasis on improving standards. Dave joined Virgin Money’s Risk function in 2019 and held various roles covering change, operational and conduct risks. In 2023 he moved to first line to head up implementation of Consumer Duty before joining Canada Life in 2024 as Head of Risk & Compliance, focusing on operational and conduct risk. Since February he has moved to first line to lead the non-financial risk taskforce which is implementing improvements to the operating environment and making sustainable changes in areas such as operational resilience, cyber and IT, third party, Consumer Duty. Dave’s focus in all of his roles has been on improving standards and thinking about the delivery of outcomes.

Armel Massimina

Operational Risk Lead

National Bank of Kuwait (International)

Armel Massimina

Operational Risk Lead, National Bank of Kuwait (International)

Currently heading the Operational Risk function at the National Bank of Kuwait in the UK, I have spent several years designing, implementing and embedding operational risk management frameworks across various sectors of financial services, including Retail Banking, Payments and FinTech. I have served on the Executive Committee of the Institute of Operational Risk Management and currently supporting the Institute of Risk Management and similar organisations in the UK and abroad, including the Caribbean.

Sowmya Murthy

Chief Risk Officer

Allianz Technology

Sowmya Murthy

Chief Risk Officer, Allianz Technology

As a Risk and Technology leader, Sowmya has over 30 years of experience in the insurance industry, covering roles in governance, technology, consulting, and business transformation. She has worked in startup, M&A and established environments and has a proven track record of overseeing large-scale transformation and establishing governance post M&A. She collaborates closely with Boards to drive risk-informed decision-making and deliver sustainable growth. She is based in Barcelona and is currently the Chief Risk Officer of Allianz Technology Group

Simon Wallis

Global Head of Risk & Assurance

IQ-EQ

Simon Wallis

Global Head of Risk & Assurance, IQ-EQ

Simon is the Global Head of Risk and Assurance at IQ-EQ and has overseen the embedding of MetricStream across the Group. Prior to IQ-EQ, Simon worked at Deloitte, Prudential plc and most recently M&G plc, holding a variety of roles across Risk and Audit. At M&G, Simon was responsible for the transformation and listing readiness of the Risk, Compliance, Legal and CoSec functions. Upon listing on the FTSE 100, Simon assumed responsibility for Operational Risk across the Group, including simplifying the approach to risk and control, overhauling the firm’s risk culture, and implementing MetricStream.

Dane Pedro

Head of UK Compliance & MLRO

Mollie UK

Dane Pedro

Head of UK Compliance & MLRO, Mollie UK

Dane is the Head of Compliance & MLRO at Mollie, specialising in risk assessments, governance frameworks, and embedding compliance cultures. She is a Justice of the Peace and senior compliance expert with over 15 years of experience in financial regulation, consumer credit, and payments. A magistrate in HM Courts and Tribunal Services, Dane is also dedicated to mentoring and supporting individuals through advisory roles.

Nam Phong Ho

Founder, Board Member and Strategic Advisor

Alpha Flow Zenith

Nam Phong Ho

Founder, Board Member and Strategic Advisor, Alpha Flow Zenith

An accomplished Governance, Risk and Compliance (GRC) Leader and Chief Audit Executive with over two decades of impact-orientated leadership experience and business acumen, transforming organisational landscapes, from startups to multinationals. Advocates ethics, integrity, digitalisation and innovation; harnesses the latest and emerging technological advancements such as data analytics and Artificial Intelligence (AI) to enable informed strategic decision-making. An influential and trusted board member who strengthens governance, Enterprise Risk Management (ERM), and increases financial and investor confidence. Showcases global exposure and scales world-class operations comprising top talent.

Elena Pykhova

Director and Founder

The Op Risk Company Ltd

Elena Pykhova

Director and Founder, The Op Risk Company Ltd

Elena Pykhova is award-winning risk expert, author, international trainer and educator. She is the founder of a boutique risk management consultancy, The OpRisk company, specializing in risk transformation, board and executive level advice on effective operational and enterprise risk management strategy, design and implementation. Elena is an author of a best-selling book, Operational Risk Management in Financial Services: A Practical Guide to Establishing Effective Solutions. She is a renowned educator, running public and in-house training courses in the UK and internationally for world-leading organisations including the London Stock Exchange Group Academy, the Moller Center Cambridge University, and the Institute of Internal Auditors. Elena is a thought leader, influencer and founder of a prominent industry think tank, the Best Practice Operational Risk Forum. She is a former Director for Education at the Institute of Operational Risk and chair of the Expert Panel for the Association of Foreign Banks. Passionate about the discipline, she founded her training and consulting practice after 20 years of experience in senior roles at Fortune 500 companies.

Michael Rasmussen

Analyst & Pundit

GRC 20/20 Research & GRC Report

Michael Rasmussen

Analyst & Pundit, GRC 20/20 Research & GRC Report

Michael Rasmussen is an internationally recognized thought leader and pioneer in governance, risk management, and compliance (GRC). With over 30 years of experience, he has extensive expertise in enterprise GRC strategy and processes supported by robust information and technology architectures. Known as the “Father of GRC,” Michael was the first to define and model the GRC market in February 2002 while at Forrester, setting the foundation for the modern understanding of GRC.

Gunjan Sinha

Executive Chairman

MetricStream

Gunjan Sinha

Executive Chairman, MetricStream

Gunjan Sinha is a visionary, entrepreneur, and business leader. He currently serves as the founder and executive chairman of MetricStream. He is probably still best known as the founder of WhoWhere?- an internet search engine which he sold to Lycos in 1998. He is also the co-founder and board member of the customer engagement software company, eGain (NASDAQ: EGAN). Throughout his career, he has been an active investor and board member in numerous successful Silicon Valley start-ups and venture funds.

Gunjan is a strong believer in social entrepreneurship, having helped create Child Family Health International, a United Nations recognized public non-profit, to transform global health education. From 2010 to 2017, Gunjan became the founding board member of the US India Endowment Board - started by the US State Department along with the Office of Science and Technology at the White House – an endowment fund that supports innovation and commercialisation of science and technology for social good in the US and India.

Gunjan is passionate about social innovation, diversity, inclusiveness, and global risk management. He envisions a world that brings the power of socially conscious innovations to better disrupt its risks, and create opportunities for all.

Gaurav Kapoor

CEO and Co-Founder

MetricStream

Gaurav Kapoor

CEO and Co-Founder, MetricStream

Gaurav Kapoor serves as the CEO and Co-Founder, MetricStream Solutions & Services. Gaurav has been involved with the company since its inception and is responsible for strategy, marketing, solutions, and customer engagement. He also served as the CFO of MetricStream until 2010.

Previously, Gaurav held executive positions at OpenGrowth and ArcadiaOne. Prior, he spent several years in business, marketing and operations roles at Citibank in Asia and in the US.

He also serves on the board of Regalix, a digital innovation and marketing company. Gaurav has a bachelor's degree in Technology (with Honors) from the Indian Institute of Technology (IIT), a degree in Business from FMS, Delhi, and an MBA from the Wharton Business School at the University of Pennsylvania, where he graduated as a Palmer Scholar.

;?>)